Summary: Learn how to tell if your car is a write-off and what it means for getting quick cash. This guide explains insurance categories, signs of a written-off vehicle, and how to sell it easily for cash in NSW.

Is your car a liability now, rather than an asset? You must sell it off now and get some quick cash. Now the question here is, when does your car become a liability? In other words, when is your car written-off? Let us discuss!

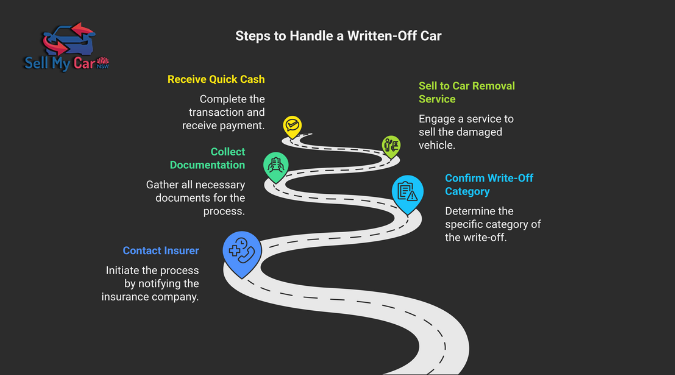

In NSW like anywhere in the world, a car is written off, or is declared a total loss, when the expenses you incur to repair it exceeds the market price, or when the damage is too severe to repair. This is typically determined by the insurer of the vehicle after a comprehensive damage assessment. There are two principal types of write-offs – Statutory Write-Offs (which cannot be repaired) and repairable write-offs (the ones that can be repaired, but it will be too expensive and hence, not financially feasible). When that happens, you must sell your car to a used car buyer in Sydney, or wherever you are.

What Does It Mean For Your Car To Be Written Off?

As and when your car is written off, a number of things happen:

Total Loss

If and when your vehicle is written off, you may consider it as a total loss. As mentioned earlier, it means the cost of its repair is either more than its current market value, or the damage is too severe to be repaired. Once that happens, the best step to take is to sell the car to the wreckers who pay quick cash for cars in Sydney as anywhere else.

Statutory Write Off (SWO): When you have your car written off after being deemed unsafe and cannot be re-registered or repaired, it is called Statutory Write Off. The only way they come in handy is by the virtue of its spare parts, which can be used as scrap metal.

Repairable Write-Off (RWO): When your car can be fixed, but the cost of the repairs is too high, then the insurer will give the verdict that your car is written off. This is what repairable write-off is, from the insurer’s perspective. Following the verdict of the insurer, you need to consult wreckers who would come with free car pickup in Sydney for cash that you deserve for your car.

The kind and degree of damage, as well as the pre-accident value of the vehicle, are all taken into consideration by insurers when evaluating the damage using standardised criteria.

What Kinds of Damage Are There?

Accidents, fires, floods, hail, and other occurrences that result in significant structural or mechanical damage are examples of damage that can lead to write-off. After that is confirmed, you need to make up your mind to sell your unwanted car for cash in Sydney.

Legal Requirements: Even if the owner is uninsured, insurers are required by law to record a car as written-off if it satisfies the requirements.

What Happens Next Once An Automobile Is Written Off?

Notification: The insurer often notifies the owner when a car is written off. Vehicle Inspection: After repairs are finished, a vehicle that is a repairable write-off would need to be examined and re-registered. However, if the owner likes, the person can sell off the vehicle to auto wreckers who pay instant cash for scrap cars in Sydney.

What Are The Financial Consequences Of Writing Off Of Vehicles?

- Insurance Payout: Depending on the market value of the car, the owner may get a payout from their insurance policy.

- Loan Repayments: If there’s outstanding finance on the vehicle, the owner will need to repay the loan, possibly with the help of motor equity insurance.

- Registration Refund: You may be entitled to a refund for the remaining portion of your vehicle registration.

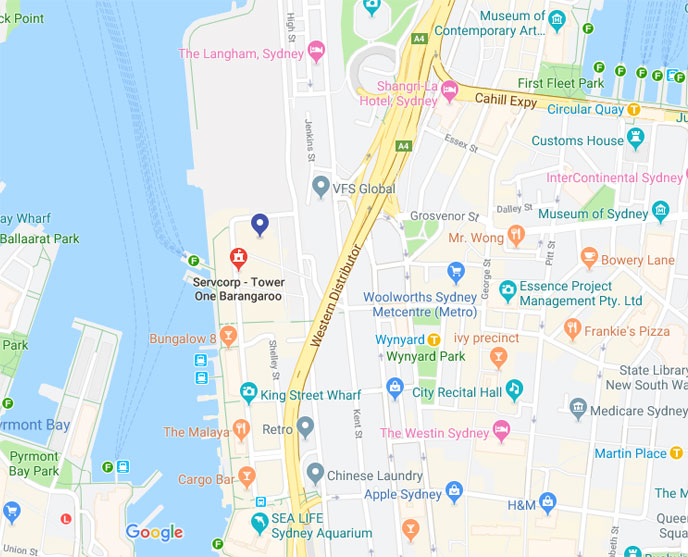

So if your car has been written off, the best step for you is to sell it off for some cash. Call Sell My Car NSW if you are in and around Sydney. Call us @ 02 8974 1523 for a free quote.

Central coast

Central coast